Player Transfers: billions spent each season, but where does it all go?

There was £1.22bn spent by Premier League clubs in the summer 2020 transfer window. It’s easy to find this figure, the headlines are always shouting how much has been spent in transfer windows. The Premier League heads the spending charts, regularly at £1.2bn – £1.4bn, with Serie A and La Liga hovering around the £1bn mark, Bundesliga and Ligue 1 around the £500m spending level. So who receives all this money? Where does it go and how might your club benefit from it?

The assumption may be that clubs spend what they receive, and the money just goes around and around, simply circulating within the football economy. That is the case for some clubs, Southampton being the best example, spending £264m and receiving £239m over 5 years. Other clubs spend more than they receive resulting in considerable net spends over the last 5 years; Man City £570m, Man Utd £504m, Arsenal £308 and Chelsea £265m leading the way.

However, for others, player sales revenue is a core element of their overall strategy and operating model. Continuing the theme of the “alternative operating model” for English clubs, there are numerous examples of clubs demonstrating the model’s success outside of the UK, especially in Europe.

Historically and outside of the Premier League, clubs would view an offer for their top player as a bit of a windfall, a chance occurrence and boost to the coffers. Do that a few times, and the fans might accuse their club of being a selling club, not happy their star player is leaving.

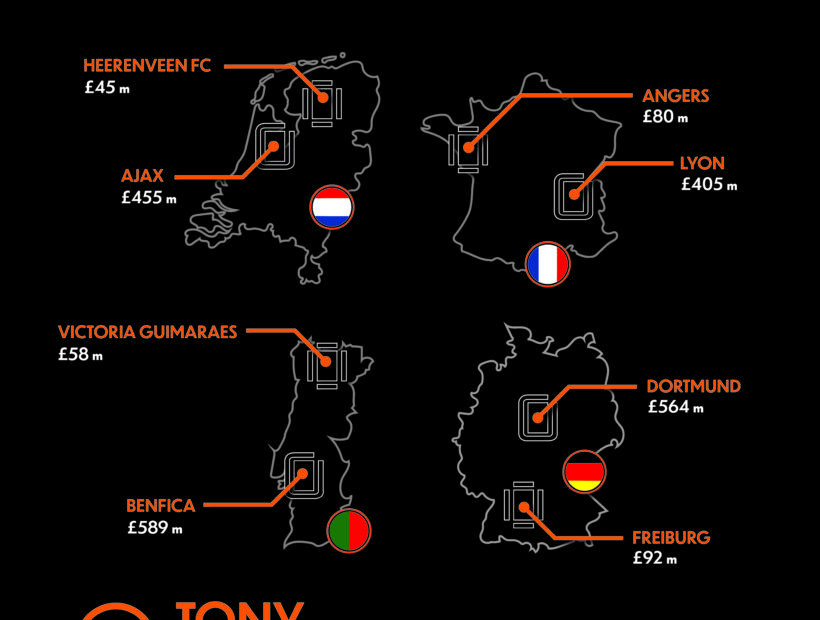

Some clubs have built their success on developing players to be better players and expecting to sell them, generating an income to be reinvested into player development. Following significant research into the European market, the graphic picks out some high profile clubs and some lesser known clubs as examples of how this model is working every season, but not attracting the headlines.

At the very top, Benfica, Dortmund, Ajax and Lyon lead the way with player sales over the last 5 years totalling £589m, £564m, 455m and £405m respectively. That is an average of £100m per club, per season of player sales revenue.

There are also some lesser known clubs who are also doing very well from player sales. Frieburg in Germany; Angers in France; Vitoria Guimares in Portugal and Heerenveen in Holland. Their 5 year player sales totals are £92m, £80m, £58m and £45m respectively, an average of just under £14m per season. This is quite astonishing, given the size of these clubs and apparent lack of success. Freiburg are due to move into a brand new stadium this season and are a Bundesliga regular now, having historically been a yoyo club – evidence that the model is working.

When you dig into the number of players traded each season, you begin to appreciate how player sales is a core element of the game. Focusing on the numbers of players arriving and departing across the last five years, a total of 386 players were transferred in and the same number transferred out of just these four relatively unknown clubs. These are huge numbers and demonstrate the sheer volume of player turnover each season. Given there is such a buoyant market for quality players at all levels, why not embrace it and use it to your own advantage?

As I have mentioned in previous blogs, many businesses (including football clubs) struggle to produce recurring profitability in a financially sustainable way, with owners and directors set in their way and closed off to external opinion, unable to see the often-obvious solutions and actions needed to overcome their challenges. Football clubs are a prime example of this, with owners continuing to do what they’ve always done – backing a manager, sacking him and then backing another manager, before sacking him and so the cycle goes on.

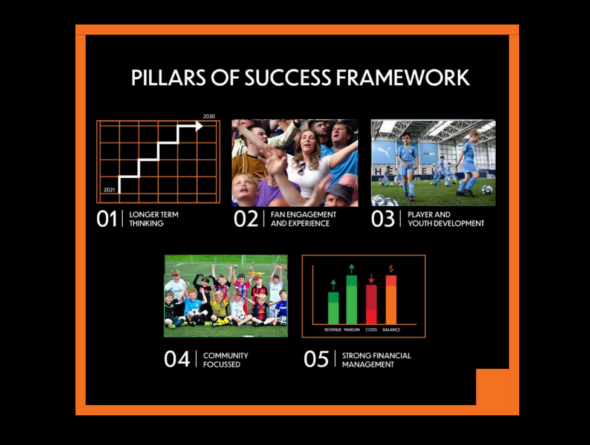

The solution is obvious – invest and focus on improving your assets, your players. Producing better players, means a better team and better ‘om pitch’ results. This will also result in player sales due to market demands, generating significant income, which can be reinvested, ultimately resulting in highly profitable and sustainable success.

A clear strategic operating model for financial sustainability.